Key Information Document (KID) - Rolling Spot Forex

1 Purpose

This document is aimed at providing you with key information regarding this specific investment product and should not be taken as marketing material.

It is a legal requirement to provide this information to help you understand the nature, risks, costs, potential gains, and losses related to this product and to enable you to compare this product against other products on offer.

2 Product

Product name: Rolling Spot Forex

Product provided by: 4T Markets Limited

Additional Information For more information, please refer to our website www.4t.co.uk

This KID was created/last updated on 28/01/2022

-

Product Description

The product is Rolling Spot Forex, but is also known or referred to as “Forex”, “FX”, “Spot Forex”, or “Leveraged Forex”. The product allows you to obtain an indirect exposure to a currency pair. This means that you will never own the underlying asset, but you will make gains or suffer losses because of price movements (fluctuations) in the underlying asset (currency pair or precious metal such as Euro (EUR) against U.S. Dollar (USD), referred to as EURUSD for immediate delivery, to which you have the indirect exposure.

Rolling Spot Forex is always traded in pairs, and trading Forex pair involves the simultaneous buying and selling of two different currencies. A Forex pair quote will show both currencies, e.g., EUR/USD, the first currency (EUR) is known as the base currency and the second (USD) is known as the variable currency. Forex trading gives an investor the choice to buy (go “long”) the currency pair if they think the price of the “base” currency will rise in relation to the “variable” or “quote” currency, or alternatively to sell (go “short”) the currency pair if they think that the price of the variable currency will rise in relation to the base currency.

3 Objective

The objective of the Forex trading is to allow an investor to gain leveraged exposure to the movement in the value of the currency pair (whether up or down), without needing to buy or sell the currency. The exposure is leveraged since the Rolling Spot Forex only requires a small proportion of the notional value of the position to be deposited upfront as initial margin.

-

Example

An investor buys 100,000 EUR/USD at 1.1250 with an initial margin amount of 3.33%, the initial investment will be 3,746.25 USD (or 3,330 EUR) (100,000 x 3.33% x 1.1250), which demonstrates the effect of leverage of, in this case 30:1 (or 3.33%). Considering the contract size for this market, for every point (pip) the market moves your profit or loss will change by 10 USD. For instance, if you are long and the market increases in value, you will earn 10 USD profit for every point (pip) the market moves. If the market decreases in value, you will make a 10 USD loss for each point (pip) it moves. If an investor holds a short position, a profit is made when the market price decreased and a loss if the market price increased.

The Rolling Spot Forex does not have a pre-defined maturity date or expiration. There is also no recommended holding period and it is down to the discretion of each individual investor to determine the most appropriate holding period based on their own individual trading strategy and objectives. Additional funds may need to be deposited in the case of negative price movement. Failure to do so may result in the Forex position being closed.

4 Intended Retail Investor

This product is not appropriate for all Retail Clients. Rolling Spot Forex is intended for investors who:

- • have knowledge of, or are experienced with, leveraged products

- • understand that by investing in this product, they could lose some or all of their investment

- • accept the risk of losing some or all of their investment in exchange for the potential of higher return

- • understand that the underlying asset can be highly volatile and the value of the product may change frequently and therefore investors should have sufficient time to monitor and manage their investments

- • have experience trading this or similar products

- • understand that trading this product will include fees that will reduce the profitability of the investment the longer the product is held

5 Risk

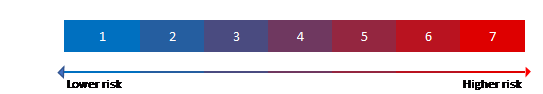

The risk indicator below is a summary of the level of risk that this product has, when compared to other products. It signifies how likely it is that the product will lose money because of market movements or because we are not able to pay you.

We have deemed this product to be 7 out of 7, which is the highest-possible risk class. This rates the potential losses from future performance of the product at an extremely high level.

The level 7 indicates that the potential losses from future performance of the product at an extremely high level. And it assumes that you may not be able to buy or sell the Forex position at a price you wanted due to the volatility of the market or you may have to buy or sell the Forex position at a price that significantly impacts how much you get back.

-

Currency risk

The currency you trade the Rolling Spot Forex in may be different from your domestic currency. If this is the case, you need to be aware of currency risk. The final return you will get depends on the exchange rate between the two currencies. This risk is not considered in the indicator shown above.

-

Underlying asset class risk

The product can also provide direct and indirect exposure to currency pairs relating to precious metals and its trading is generally characterized by high risk, but which also allows for the opportunity of high returns. The product can be expected to have large fluctuations due to the nature of the asset class the product is exposed to.

-

Capital protection risk

This product does not include any protection from future market performance so you could lose some or the entire amount you invest.

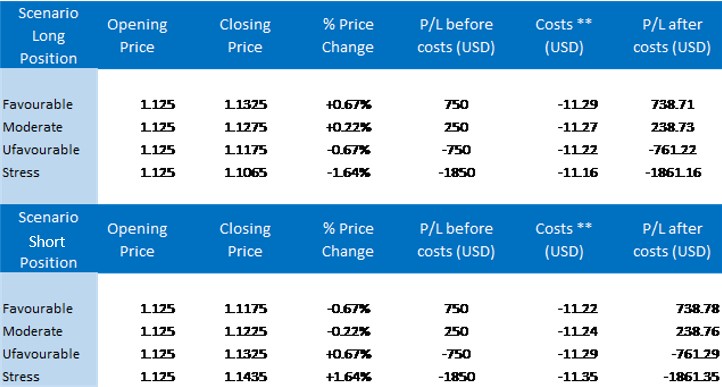

6 Performance Scenarios

The scenarios outlined in this section are designed to show you how your investment could perform. It would be good practice to compare them with the relative scenarios of other products. These scenarios are an estimate of future performance based on past evidence on how the value of this investment may vary, and are, by no means, an exact indicator. Any returns you receive depend on how the market performs and how long you hold the pair for. The stress scenario signifies what you may receive in extreme market circumstances and does not consider a situation where 4T Markets Limited is not able to pay you.

The scenarios are based on the following assumptions of an intraday Rolling Spot Forex trade in EUR/USD:

- • Opening Price (P) = 1.1250

- • Trade Size (TS) = 100,000

- • Margin % (M) = 3.33%

- • Margin Requirement (MR) = P x TS x M = 3,746.25 USD (3,330.00 EUR)

- • Notional value of the trade (TN) = MR / N = 112,500 USD (100,000 EUR)

* If the position is held overnight, the overnight fee is charged. Overnight fees depend on the currency interest rates and are changed frequently. Current overnight fees can be found in the Client's area.

**Costs include trade fees.

7 What Happens If 4T Markets Limited Is Unable to Pay Out?

If 4T is unable to meet its financial obligations to you, you may lose the value of your investment. However, 4T segregates all retail client funds from its own money, in accordance with the UK FCA’s Client Asset rules. 4T also participates in the UK’s Financial Services Compensation Scheme (FSCS) which covers eligible investments up to GBP 85,000.

Individuals are eligible under the FSCS scheme and smaller businesses may also be eligible. Larger businesses are generally excluded from the FSCS scheme. See www.fscs.org.uk.

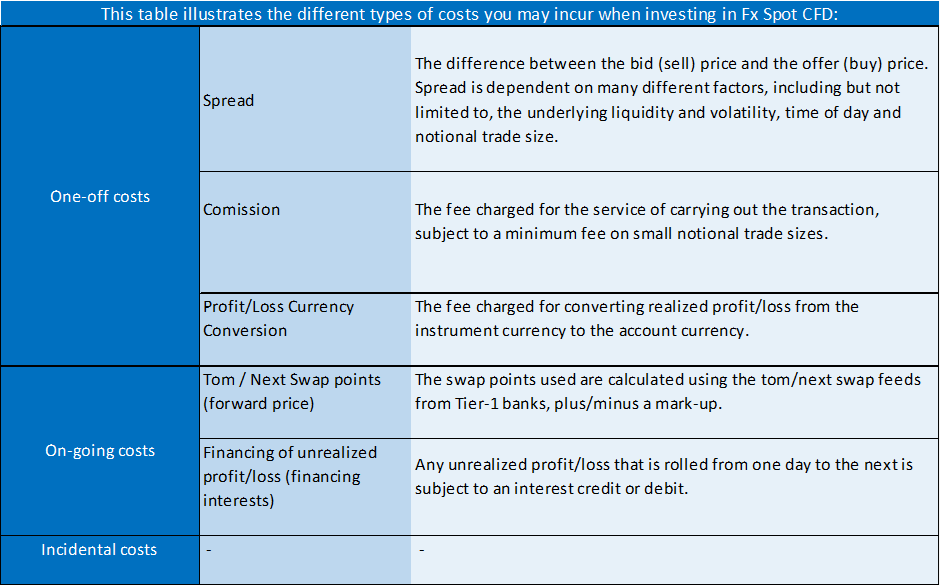

8 What are the costs?

The cost to open and close a trade will depend on the account type you hold and the relevant applicable charges. These are usually a spread between the bid and ask price of the pair that you are trading, and/or a commission charged based on the size of your trade. In addition to that, you will pay an overnight fee (also called rollover or swap) for every day that your position is open.

Please refer to www.4t.co.uk where you can find details of the account types and commissions paid. The table below shows where costs are incurred.

9 How long should I hold it, and can I take my money out early?

Rolling Spot Forex does not have any recommended holding period, and generally is used for short time trading. There is no lock-up period, and you can liquidate the trading position and monetize the financial result at any time after you open the trading position.

10 How can I complain?

If you are dissatisfied with any aspect of the service provided to you by 4T Markets Limited, you may, in the first instance, contact our Client Management Team either by phone on +44 (0)203 819 3100 or by email at [email protected]

If you do not feel that your complaint has been resolved satisfactorily, you may refer your complaint to the Financial Ombudsman Service (FOS). Please refer to www.financial-ombudsman.org.uk for further information.

11 Other relevant information

If there is a time lag between the time you place your order and the moment it is executed, your order may not be executed at the price you expected. Ensure your internet signal strength is sufficient before trading. Our website contains important information regarding your account. You should ensure that you are familiar with all the documents that apply to your account. The information contained in this Key Information Document does not constitute a recommendation to buy or sell the product and is no substitute for individual consultation with the investor’s bank or advisor. The KID is a pre-contractual document which gives you the main information about the product (characteristics, risks, costs, etc.).